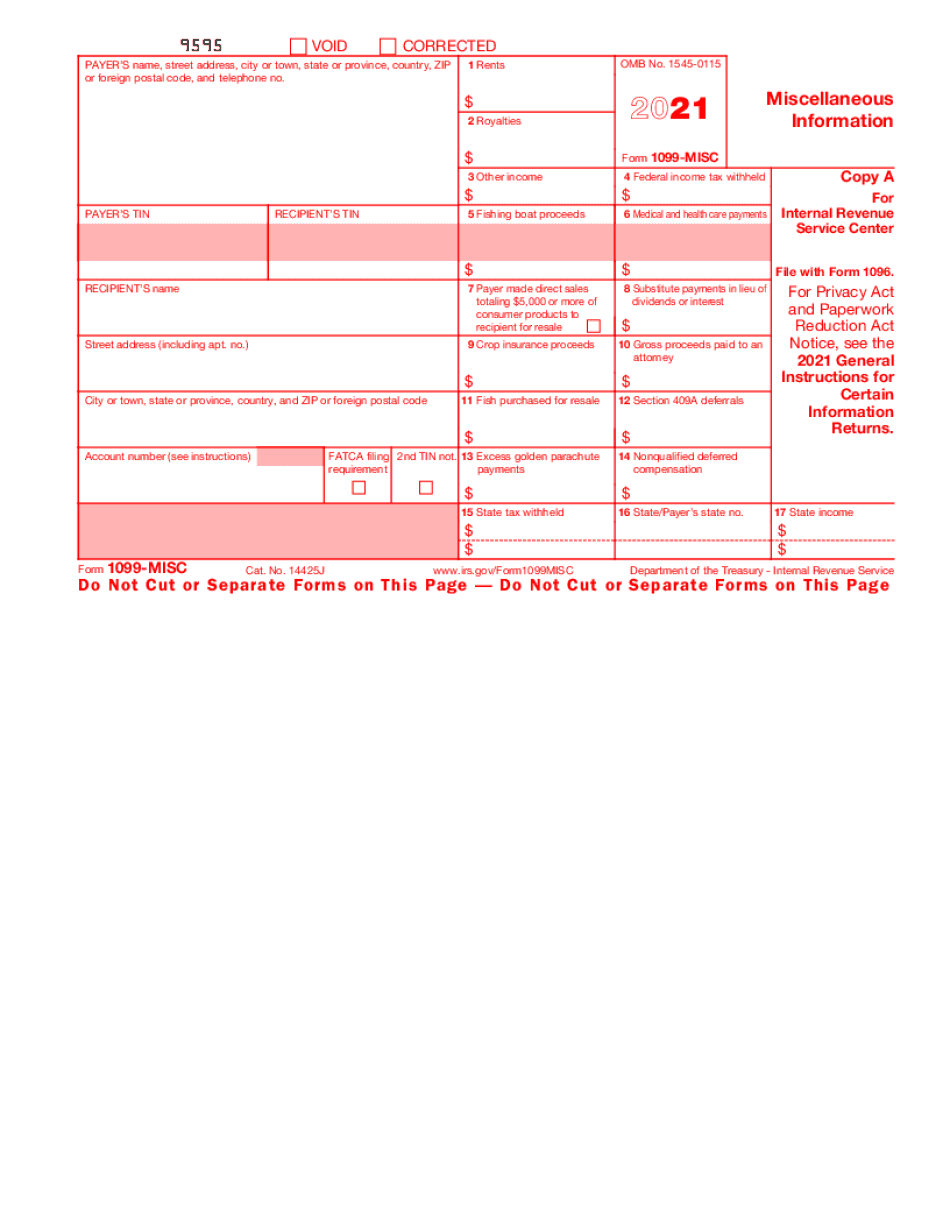

Filling out 1099-MISC online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to 1099-MISC

Every person must declare their finances in a timely manner during tax period, providing information the Internal Revenue Service requires as precisely as possible. If you need to 1099-MISC, our reliable and user-friendly service is here to help.

Follow the steps below to 1099-MISC quickly and accurately:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official instructions (if available) for your form fill-out and precisely provide all information required in their appropriate fields.

- 03Fill out your document utilizing the Text tool and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Take advantage of the Highlight option to accentuate particular details and Erase if something is not applicable anymore.

- 06Click the page arrangements button on the left to rotate or delete unnecessary document sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to ensure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by adding its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or select Mail by USPS to request postal document delivery.

Choose the simplest way to 1099-MISC and declare your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

Watch our video guide to learn how to prepare 1099-MISC

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of 1099-MISC?

You report on your 1040 tax return.

Is it a filing status?

1099-MISC is the form you use for reporting your gross income on your tax return, whether you pay taxes online or by paper. There is no qualifying statute of limitations in 1099-MISC for filing your taxes in 2018.

Does it have a penalty?

Yes. If you report no income or deductions on page 1 of Form 1099-MISC, no tax is withheld from your paycheck unless your Form 1099-MISC indicates your gross income was 200 or more. For more information, see Publication 1041, Tax Bulletin, at and Internal Revenue Bulletin 2017-21, Tax Return Credits, at IRS.gov.

I already filed my taxes online. What if I do not have a 1099-MISC?

You can still file your tax return online or by paper if you have a prior-year Form 1099-MISC, which is due by April 15, 2017. The form you need depends on the type of income you reported for prior tax years. You can find the form you need on IRS.gov and submit it by paper or email to us. For more information, see Publication 646, Social Security and Medicare Taxes; Publication 525, Distributions From Individual Retirement Arrangements; and Publication 1320A, Tax Form 1040-C.

What if I didn't report income or had income that was zero, negative, or zero-dependent?

If you didn't give full information on Form 1045-PR, the Income Tax Return for Individuals, you must continue to file a Form 1040 and not use Form 1045-PR or Form 1041, because you still have income the government doesn't expect to collect. If your taxable income is zero or negative, you cannot use the form you need. If you owe taxes, we'll contact you before you file your returns. For more information, see Publication 505, Tax Guide for Small Business, at.

What if my gross income is zero?

If your gross income is zero, the taxpayer can't use Form 1040 or 1040A. However, you can still file your tax return, using either Form 1040 or Form 1040A.

Who should complete 1099-MISC?

Individuals who qualify as individuals. If you do not qualify as the primary U.S. holder, only an individual can qualify. You cannot complete 1099-MISC if you are engaged in any of the activities listed below.

Who should complete 1099-INT?

Individuals who qualify as individual. An individual cannot qualify as an individual if he or she is a corporation, partnership, association or partnership S corporation, for example a domestic corporation or a foreign corporation (the company is no longer an incorporated entity).

Who should complete 1099-K?

Employees or independent contractors. Employees who receive compensation of more than 600 per month (including commissions, salaries, wages, or other forms of remuneration) or independent contractors who receive compensation of 600 or more per month, as an employee of a seller.

This amount includes amounts paid as dividends from an employer, contributions to an employee retirement plan, payments for goods and services, payments by a financial institution on behalf of the employee, payments by a contractor on the employee's behalf, and any other payment of a comparable value.

The amount does not include a payment for goods or services if the payment is based upon the employee's participation in a trade or business, provided the payee is not a seller of goods and services.

Who should complete 1099-MISC?

The purchaser is the person or organization that makes the payment. Payment is made to the seller via a financial institution. Payments to individual sellers should be reported only by name and employer, not by business location.

Payments by non-profits, educational organizations, religious organizations, non-profit public charities, and trade or business associations are not reported.

An organization who is required to file an S Corporation tax return may file a 1099-MISC. This is true whether the income source for pay from the organization is an S corp or an individual.

A person purchasing a vehicle at a commercial vehicle dealer or towing company should complete a 1099-MISC as the manufacturer.

If an individual buys a new home for himself or herself with a mortgage and then rents it out for a few months, the individual does not make any payments on the home loan and so the individual will not be reporting payments from the mortgage income.

If you buy a new car, you should complete your own individual form.

When do I need to complete 1099-MISC?

If you are engaged in the business of a bar, or other restaurant, that is primarily engaged in the sale of alcohol for consumption on the premises, you may also need to complete a W-2G. For example, if you run a restaurant that serves food and has an employee in a full-time position, that employee is required to have a W-2G. If you are a bartender at a strip club, that business needs a W-2G. For example, a bar owner who requires only bartenders and not hostesses or waitresses and who is not required to file taxes for those employees may have the business in W-2G at tax time with no income tax due.

If you are a business owner who owns 10 or more workers and your business is primarily engaged in the distribution of merchandise for noncustomers, or a business whose sale goods are not intended for resale, you will need to complete a W-2G. For example, if you manufacture and sell household products and have one employee, you need a W-2G. If you manufacture and sell home furnishings and have 5 employees, you also need a W-2G.

If you are a small business owner who does have employees, but does not sell any products or services, you should consider filing as a sole proprietor. As a sole proprietor, you can file your own forms and pay only the W2G. In those cases, if you sell or distribute products or services, you are not required to file a W2G.

What should I write on the W-2G form?

The employee will sign any form or statement required. The employee should be able to clearly read the form because there is no space for any comments for the employee on his or her W-2G. Some example statements on the form include:

“I certify that I can perform the duties of the position for the period listed and for which I am being paid.”

“Under penalty of perjury, I certify that I have a legitimate right to be employed at this job and that I do not claim any existing or future employment, and my income should not be taxed, as an employee, by my employer.”

“I declare that I am a citizen of the United States and that I am a legal resident of the United States.

Can I create my own 1099-MISC?

For an individual, you can start by completing Form 1095-MISC which is available from any U.S. tax office. It is designed to provide a list of deductions that will be available to you.

For businesses, you should consult your state department of revenue for the most accurate tax information to be available to you.

Are there any tax credits available on my 1099-MISC?

Yes. You can claim a reduction on your individual and household income tax filings. You must apply for the tax credit by January 31 of each year, and it is available for one calendar year.

What should I do with 1099-MISC when it’s complete?

This is the first thing you should do. You should check to see if you are registered and the employer's name and address appear on tax forms. If so, you've got the right to keep everything.

If you aren't completely happy with the amount you received, you have the right to file a grievance claim within five business days. Contact the IRS to file a grievance claim.

How do I get my 1099-MISC?

If you are an “employee” you do not have to file Form W-2 for your income under the W-2 payroll withholding requirements. Employers are required to withhold 10% of your “employees” annual income from your paycheck. However, they are not required to withhold anything more than this amount.

If you work for a corporate entity, you receive an IRS form 1099-MISC. This is a form that employers use to report their annual “wage and salary” contributions by the business. Employees do not need to file this form either.

Employees are required to submit copies of the 1099-MISC forms they receive through payroll deduction with the IRS. You can submit copies of 1099-MISC forms electronically through our electronic system or print these forms and mail them. Or you can simply print the Form 1099-MISC. You can choose to have a copy mailed to you through the postal service.

How To Get Your W8-BEN

If you are an employee, you will want to get the Form W8-BEN form that can help you obtain a business income tax return. If you work for business owners, you might want to get a copy of the Taxpayer Assistance Guide for Businesses, 1041. The 1040EZ and 1040A are required forms for businesses too.

What documents do I need to attach to my 1099-MISC?

You may need to attach one of the following documents to your 1099-MISC:

Pursuant to section 1040A of the Internal Revenue Code (and its regulations), your employment contract, pay stubs, pay stubs or similar documents showing you earned income while you worked for the qualifying employer; provided that your pay stub (or pay stubs/pay stubs when accompanied by your pay stubs/pay stubs when accompanied by a W-4) is for work performed under an employer plan and your W-4 does not have an incorrect balance and the amount shown on your W-4 does not differ in any significant respect from what amounts to your gross wages. Examples of qualifying employment, employment contracts, W-4s and pay stubs are identified in Section A.

Provided that your pay stub (or pay stubs/pay stubs when accompanied by your pay stubs/pay stubs when accompanied by a W-4) is for work performed under an employer plan and your W-4 does not have an incorrect balance and the amount shown on your W-4 does not differ in any significant respect from what amounts to your gross wages. Example of qualifying employment, employment contracts, W-4s and pay stubs are identified in Section A. A. A W-2 from your employer.

B. A W-2 from your pay stub when accompanied by a copy of your W-4 when accompanied by copies of documents, including a copy, certified as a true and correct copy, of your contract with your qualifying employer.

C.

What are the different types of 1099-MISC?

Most people get an 1099-MISC because they made a transaction that is either part of a business or is for business expenses. The 1099-MISC can be used by:

Your employer. If you're an employee or your employer pays your wages, you get a 1099-MISC if the 1099 represents wages and not sales.

. If you're an employee or your employer pays your wages, you get a 1099-MISC if the 1099 represents wages and not sales. Your customers. For you to be eligible for the 1099-MISC you must be a customer of the business.

. For you to be eligible for the 1099-MISC you must be a customer of the business. A person who qualifies as an independent contractor. A person is covered if the payments represent earnings under a contract of employment.

You may also get a 1099-MISC when you are self-employed. This is true even if the transaction is not for a business.

What is the difference between a 1099-MISC issued by the IRS and a 1099-S form that you have to report to us?

There are some common differences. The following examples illustrate the two:

Schedule A, Part III itemizes the taxes for the month. The 1099-S form just lists the income on line 14 of the tax return with no deductions. Schedule B, Part IX describes the payments made by you. It does not itemize deductions like the 1099-MISC. Schedule C, Part III and the schedule to Part VII, line 28, itemize deductions.

In both cases, if you make taxable income less than your net profit for the month, you have to file a 1040X form to include it in gross income.

Does the 1099-C form indicate how I have to include the taxes for the month?

The 1099-C form does not include a statement showing the amount you have to include in your income. If you are not sure if you have to file a tax return, check the instructions on the form to see if it includes other instructions. If you have any questions, ask the business or the IRS.

Does the 1099-MISC have one?

Yes. 1099-MISC is generally also called Schedule C-EZ, or Schedule C-EZ-EZ.

How many people fill out 1099-MISC each year?

In addition to a tax identification number, the 1099 form helps businesses find out how much of the money they earn is taxable.

1099-MISC provides an estimated or 'guaranteed' taxable income from services.

Example: Your taxes are deducted, and you are provided a 1099-MISC form. It should indicate that the income you earned is taxable.

How is 1099-MISC reported?

All businesses who want to report their 1099-MISC payments are required to pay payroll taxes. The 1099-MISC form is also printed on employer's W-2 forms. Taxpayers are allowed to report the amount they earn and report their income on multiple forms of payment.

How to report your 1099-MISC income

As a business owner, prepare and submit forms showing your 1099-MISC income and pay withholding tax to the IRS to obtain this report.

Where to report your 1099-MISC earnings to the IRS

The IRS allows you to report 1099-MISC earnings on either federal income tax return or state income tax return. The forms for those reporting income are the 1099-MISC income form and the W2 income form.

Reporting 1099-MISC earnings: Federal tax return If your business earns all the money from 1099-MISC income on one tax return, you are required to complete the 1099-MISC income form online or on paper. Use the online 1099-MISC or paper 1099-MISC forms to show your employer the money (or your share of it) received from the person receiving the 1099-MISC form. For more information, see IRS Publication 15 — Employers for Businesses on How to Report and Collect Employment Tax, and Revenue Procedure 2010-40, Revenue Procedure 2010-49 — Payments by Unnamed Agents to Your Business. State income tax return If you are a small business, your business is not a sole proprietorship or is incorporated, you may report 1099-MISC earnings on a state income tax return. If your state collects and remits its individual income tax and employee withholding, reporting 1099-MISC earnings on that tax return should not be difficult.

Is there a due date for 1099-MISC?

Yes. The Due Date for a return is generally the date on which you are notified by the IRS that you have earned enough in income from taxable transactions to be entitled to a tax return form.

Example

You have made 10,000 in taxable income and paid 2,000 in income tax. On this date you may be classified as a long-term unemployed person, or LTRP. The Due Date is February 8. You may have earned over 8,000 at some point prior to your Due Date. You may qualify for 1099-MISC as a result, or you may not.

To learn more see: IRS Publication 1020, Long-Term Unemployment Tax Guide.

What is the due date for Form 1040, 1040A, 1040EZ — Employer's Withholding Tax Return and Annual Return for FICA Tax?

The Due Date of Form 1040, 1040A, or 1040EZ is due on the same date on which you file your individual income tax return. This date varies based upon the filing status and classification of an individual.

For more information, see: What Do I Need to File With the IRS Regarding 1040?

What can I expect from my return when they arrive at my doorstep?

You should receive your personal statement within 4 weeks after your tax return is mailed. You should receive a copy of your Form 1040, 1040A, or 1040EZ a few weeks later.

Form 1040A and Form 1040EZ are self-reportable forms that are mailed to taxpayers by the IRS. Therefore, the IRS cannot accept returns via mail or in person. The IRS recommends filing the forms online once you have filed your tax return. A search for your filing status on IRS.gov can point you in the right direction.

In addition, there are IRS online filing options that are designed for taxpayers who can't make it to IRS offices for filing due to a physical or illness. Some IRS filing options exist to help taxpayers avoid certain paper filing requirements such as filing extensions, filing paper returns, printing paper forms, or having your tax return sent to collections. For more information, see: IRS Online Tax Filing Options and IRS Paper Free File.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here